Langgan Saluran FX V.1.3.1

Kalkulator margin

Kira margin minimum yang diperlukan setiap lot

-

Sesi Dagangan (pemula)

-

Masa kejadian harga tinggi/rendah harian (pemula)

-

Rintangan dan sokongan carta (Pemula)

-

Laporan CFTC COT (pemula)

-

Pengesanan Gelombang Elliott (Pertengahan)

Sesi dagangan

Market Sessions

Kod program:

Pine Script

Pengenalan:

Penunjuk mudah yang membantu anda menjejaki 4 sesi dagangan pasaran (Tokyo, London, New York, Sydney secara lalai), dipersembahkan dalam 4 bentuk visual yang berbeza (kotak, garis masa, kawasan, batang lilin berwarna) dan menyediakan Banyak alat berguna lain. Penunjuk ini boleh membantu anda lebih memahami aktiviti dan pertindihan masa pelbagai sesi dagangan pasaran, membolehkan anda merancang dan melaksanakan strategi dagangan dengan lebih baik.

Fungsi:

Anda boleh menunjukkan/menyembunyikan semua sesi dagangan, menamakan semula, menukar warna dan menetapkan masa mula/tamat. Anda boleh menyesuaikan penampilan dan tetapan penunjuk untuk memenuhi keperluan dagangan dan keutamaan peribadi anda. Sesuaikan ia dengan keperluan dan rangka masa anda untuk menjejak dan menganalisis aktiviti pasaran dengan lebih baik.

Ciri tambahan:

- "Tukar (Pips)" - akan menambah perbezaan pip antara tinggi dan rendah sesi dagangan, atau harga buka dan tutup sesi dagangan, pada label sesi dagangan.

- "Tukar (%)" - akan menambah perbezaan peratusan antara tinggi dan rendah sesi dagangan, atau perbezaan peratusan antara harga pembukaan dan penutupan sesi dagangan, pada label sesi dagangan.

- "Gabung Bertindih" - Ini akan menggabungkan sesi dagangan bertindih, menunjukkan hanya satu sesi pada satu masa (masa tamat Tokyo berpindah ke masa mula London, masa tamat London berpindah ke masa mula New York, masa tamat New York berpindah ke masa mula Sydney, Sydney masa tamat berpindah ke masa mula Tokyo).

- "Sembunyikan Hujung Minggu" - Ini akan menghalang skrip daripada melukis sesi dagangan pada hujung minggu (apabila pasaran ditutup).

- "Barisan Buka/Tutup" - Ini menarik garisan daripada harga pembukaan sesi dagangan kepada harga penutup (atau harga semasa jika sesi dagangan sedang berjalan).

- "Tempoh 0.5 Tahap" - Ini akan menarik garis mendatar antara sesi dagangan tinggi dan rendah, separuh ke bawah.

- "Lilin Berwarna" - Ini akan mewarnakan lilin menggunakan warna sesi dagangan untuk menunjukkan sesi dagangan yang dimilikinya.

- "Jenis Paparan" - Pilih antara tiga cara berbeza untuk menggambarkan sesi dagangan (Kotak, Kawasan dan Batang Lilin).

- "Hari Imbas Kembali" - Input ini memberitahu skrip untuk hanya merancang sesi dagangan untuk X hari lalu (1 = 1 hari).

- "Tukar (% / Mata)" - Pilih tab "Tukar (Mata)" dan "Tukar (%)" di sini. Memilih "Sesi Dagangan Tinggi/Rendah" akan menunjukkan jumlah perubahan antara sesi dagangan tinggi dan rendah, dan memilih "Sesi Dagangan Buka/Tutup" akan menunjukkan jumlah perubahan antara sesi dagangan dibuka dan ditutup.

- "Zon Masa Input" - Ini mentakrifkan zon waktu untuk input masa mula/akhir sesi dagangan (anda tidak perlu menukar ini melainkan anda tahu apa yang anda lakukan).

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © 1uptick

//@version=5

indicator("Market Sessions", overlay = true, max_boxes_count = 500, max_labels_count = 500, max_lines_count = 500)

// Box generation code inspired by Jos(TradingCode), session box visuals inspired by @boitoki

// Session 1 - user inputs

showTokyo = input.bool(true, '', inline='Tokyo', group='Sessions')

stringTokyo = input.string('Tokyo', '', inline='Tokyo', group='Sessions')

TokyoTimeX = input.session(defval="0000-0900", title=' ', inline='Tokyo2', group='Sessions', tooltip = 'If you want to change the start/end time of the session, just make sure they are in UTC. There is no need to change the timezone of your Tradingview chart or to change the Timezone input below, because the sessions will be plotted correctly as long as the start/end time is set in UTC.')

TokyoCol = input.color(color.rgb(255, 153, 0, 90), '' , inline='Tokyo', group='Sessions')

// Session 2 - user inputs

showLondon = input.bool(true, '', inline='London', group='Sessions')

stringLondon = input.string('London', '', inline='London', group='Sessions')

LondonTimeX = input.session(defval="0700-1600", title=' ', inline='London2', group='Sessions', tooltip = 'If you want to change the start/end time of the session, just make sure they are in UTC. There is no need to change the timezone of your Tradingview chart or to change the Timezone input below, because the sessions will be plotted correctly as long as the start/end time is set in UTC.')

LondonCol = input.color(color.rgb(76, 175, 79, 90), '' , inline='London', group='Sessions')

// Session 3 - user inputs

showNewYork = input.bool(true, title='', inline='New York', group='Sessions')

stringNewYork = input.string('New York', '', inline='New York', group='Sessions')

NewYorkTimeX = input.session(defval="1300-2200", title=' ', inline='New York2', group='Sessions', tooltip = 'If you want to change the start/end time of the session, just make sure they are in UTC. There is no need to change the timezone of your Tradingview chart or to change the Timezone input below, because the sessions will be plotted correctly as long as the start/end time is set in UTC.')

NewYorkCol = input.color(color.rgb(33, 149, 243, 90), '', inline='New York', group='Sessions')

// Session 4 - user inputs

showSydney = input.bool(false, title='', inline='Sydney', group='Sessions')

stringSydney = input.string('Sydney', '', inline='Sydney', group='Sessions')

SydneyTimeX = input.session(defval="2100-0600", title=' ', inline='Sydney2', group='Sessions', tooltip = 'If you want to change the start/end time of the session, just make sure they are in UTC. There is no need to change the timezone of your Tradingview chart or to change the Timezone input below, because the sessions will be plotted correctly as long as the start/end time is set in UTC.')

SydneyCol = input.color(color.rgb(164, 97, 187, 90), '', inline='Sydney', group='Sessions')

// Additional tools and settings - user inputs

pipChange = input.bool(false, 'Change (Pips) ', inline='0', group = 'Additional Tools and Settings')

percentChange = input.bool(false, 'Change (%)', inline='0', group = 'Additional Tools and Settings')

merge = input.bool(false, 'Merge Overlaps', inline='2', group = 'Additional Tools and Settings')

hideWeekends = input.bool(true, 'Hide Weekends', inline='2', group = 'Additional Tools and Settings')

sessionOC = input.bool(true, 'Open/Close Line', inline='3', group = 'Additional Tools and Settings')

halfline = input.bool(false, 'Session 0.5 Level', inline='3', group = 'Additional Tools and Settings')

colorcandles = input.bool(false, 'Color Candles ', inline='4', group = 'Additional Tools and Settings')

showScreener = input.bool(false, 'Screener (Soon)', inline='4', group = 'Additional Tools and Settings')

displayType = input.string('Boxes', 'Display Type', options = ['Boxes', 'Zones','Timeline', 'Candles'], group='Additional Tools and Settings', tooltip='Choose whether the scripts should plot session in the for of boxes or colored background zones.')

daysBack = input.float(150, 'Lookback (Days)', group='Additional Tools and Settings', tooltip= 'This inputs defines the lookback period for plotting sessions. Eg. If it is set to 1, only the sessions of the past day will appear')

changeType = input.string('Session High/Low','Change (%/Pips) Source', options = ['Session High/Low', 'Session Open/Close'], group='Additional Tools and Settings', tooltip='Choose whether the Change (%) and Change (Pips) should measure the distance between Session High and Session Low or the distance between Session Open and Session Close.')

SessionZone = input.string("UTC", title="Input Timezone", group='Additional Tools and Settings', tooltip = 'This input is defining the timezone for the session times selected above. It has nothing to do with the timezone of your chart, because the sessions will be plotted correctly even if your chart is not set to UTC.')

// Appearance - user inputs

borderWidth = input.int(1, 'Box Border', inline='border', group='Appearance')

borderStyle = input.string('Dashed', '', ['Solid', 'Dashed', 'Dotted'] , inline='border', group='Appearance', tooltip='Select the width and style of session box borders')

levelsStyle = input.string('Dashed', 'Line Style', ['Solid', 'Dashed', 'Dotted'], group='Appearance', tooltip='Select the style of 0.5 and Open/Close lines.')

labelSize = input.string('Normal', 'Label Size', options = ['Auto', 'Tiny', 'Small', 'Normal'], group='Appearance', tooltip='Select the size of text labels.')

showLabels = input.bool(true, 'Session Labels ', inline='00', group = 'Appearance')

colorBoxes = input.bool(true, 'Box Background', inline='00', group = 'Appearance')

// Excluding or Including Weekends

var TokyoTime = hideWeekends ? TokyoTimeX+":123456" : TokyoTimeX+":1234567"

var LondonTime = hideWeekends ? LondonTimeX+":123456" : LondonTimeX+":1234567"

var NewYorkTime = hideWeekends ? NewYorkTimeX+":123456" : NewYorkTimeX+":1234567"

var SydneyTime = hideWeekends ? SydneyTimeX+":123456" : SydneyTimeX+":1234567"

// Defining Line Style and Label Size Variables

lineStyle(x) =>

switch x

'Solid' => line.style_solid

'Dashed' => line.style_dashed

'Dotted' => line.style_dotted

labelStyle(x) =>

switch x

'Auto' => size.auto

'Tiny' => size.tiny

'Small' => size.small

'Normal' => size.normal

// Calculating inRange, used for lookback

MSPD = 24 * 60 * 60 * 1000

lastBarDate = timestamp(year(timenow), month(timenow), dayofmonth(timenow), hour(timenow), minute(timenow), second(timenow))

thisBarDate = timestamp(year, month, dayofmonth, hour, minute, second)

daysLeft = math.abs(math.floor((lastBarDate - thisBarDate) / MSPD))

inRange = daysLeft < daysBack

// Session Time

InTokyo(TokyoTime, TokyoTimeZone=syminfo.timezone) =>

not na(time(timeframe.period, TokyoTime, SessionZone))

InLondon(LondonTime, LondonTimeZone=syminfo.timezone) =>

not na(time(timeframe.period, LondonTime, SessionZone))

InNewYork(NewYorkTime, NewYorkTimeZone=syminfo.timezone) =>

not na(time(timeframe.period, NewYorkTime, SessionZone))

InSydney(SydneyTime, SydneyTimeZone=syminfo.timezone) =>

not na(time(timeframe.period, SydneyTime, SessionZone))

// Creating variables Session High, Low, Open and Session Boxes, Lines and Texts

var TokyoHighPrice = 0.0, var TokyoLowPrice = 0.0, var TokyoOpenPrice = 0.0, var box TokyoBox = na, var line TokyoLine = na, var label TokyoLabel = na, var line TokyoOC = na, var string TokyoText = str.tostring(stringTokyo)

var LondonHighPrice = 0.0, var LondonLowPrice = 0.0, var LondonOpenPrice = 0.0, var box LondonBox = na, var line LondonLine = na, var label LondonLabel = na, var line LondonOC = na, var string LondonText = str.tostring(stringLondon)

var NewYorkHighPrice = 0.0, var NewYorkLowPrice = 0.0, var NewYorkOpenPrice = 0.0, var box NewYorkBox = na, var line NewYorkLine = na, var label NewYorkLabel = na, var line NewYorkOC = na, var string NewYorkText = str.tostring(stringNewYork)

var SydneyHighPrice = 0.0, var SydneyLowPrice = 0.0, var SydneyOpenPrice = 0.0, var box SydneyBox = na, var line SydneyLine = na, var label SydneyLabel = na, var line SydneyOC = na, var string SydneyText = str.tostring(stringSydney)

// Checking if session is active/has started

inTokyo = InTokyo(TokyoTime, SessionZone) and timeframe.isintraday

TokyoStart = inTokyo and not inTokyo[1]

inLondon = InLondon(LondonTime, SessionZone) and timeframe.isintraday

LondonStart = inLondon and not inLondon[1]

inNewYork = InNewYork(NewYorkTime, SessionZone) and timeframe.isintraday

NewYorkStart = inNewYork and not inNewYork[1]

inSydney = InSydney(SydneyTime, SessionZone) and timeframe.isintraday

SydneyStart = inSydney and not inSydney[1]

// Settings high, low, open at the beggining of the session

if TokyoStart

TokyoHighPrice := high

TokyoLowPrice := low

TokyoOpenPrice := open

if LondonStart

LondonHighPrice := high

LondonLowPrice := low

LondonOpenPrice := open

if NewYorkStart

NewYorkHighPrice := high

NewYorkLowPrice := low

NewYorkOpenPrice := open

if SydneyStart

SydneyHighPrice := high

SydneyLowPrice := low

SydneyOpenPrice := open

// Track session's max high and max low during the session

else if inTokyo

TokyoHighPrice := math.max(TokyoHighPrice, high)

TokyoLowPrice := math.min(TokyoLowPrice, low)

else if inLondon

LondonHighPrice := math.max(LondonHighPrice, high)

LondonLowPrice := math.min(LondonLowPrice, low)

else if inNewYork

NewYorkHighPrice := math.max(NewYorkHighPrice, high)

NewYorkLowPrice := math.min(NewYorkLowPrice, low)

else if inSydney

SydneyHighPrice := math.max(SydneyHighPrice, high)

SydneyLowPrice := math.min(SydneyLowPrice, low)

// Plotting session boxes at the beginning of each session

if TokyoStart and showTokyo and inRange

TokyoBox := displayType=='Boxes' ? box.new(left=bar_index, top=na, right=na, bottom=na, border_width=borderWidth, bgcolor = colorBoxes ? TokyoCol : na, border_style = lineStyle(borderStyle), border_color=color.new(TokyoCol, 40)) : na

TokyoLine := halfline ? line.new(x1=bar_index, y1=na, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(TokyoCol, 40)) : na

TokyoLabel := showLabels ? label.new(x=na, y=na, text=TokyoText, textcolor=color.new(TokyoCol, 40), color=color.rgb(0,0,0,100), size=labelStyle(labelSize)) : na

TokyoOC := sessionOC ? line.new(x1=bar_index, y1=TokyoOpenPrice, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(TokyoCol, 40)) : na

if LondonStart and showLondon and inRange

LondonBox := displayType=='Boxes' ? box.new(left=bar_index, top=na, right=na, bottom=na, border_width=borderWidth, bgcolor = colorBoxes ? LondonCol : na, border_style = lineStyle(borderStyle), border_color=color.new(LondonCol, 40)) : na

LondonLine := halfline ? line.new(x1=bar_index, y1=na, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(LondonCol, 40)) : na

LondonLabel := showLabels ? label.new(x=na, y=na, text=LondonText, textcolor=color.new(LondonCol, 40), color=color.rgb(0,0,0,100), size=labelStyle(labelSize)) : na

LondonOC := sessionOC ? line.new(x1=bar_index, y1=LondonOpenPrice, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(LondonCol, 40)) : na

if NewYorkStart and showNewYork and inRange

NewYorkBox := displayType=='Boxes' ? box.new(left=bar_index, top=na, right=na, bottom=na, border_width=borderWidth, bgcolor = colorBoxes ? NewYorkCol : na, border_style = lineStyle(borderStyle), border_color=color.new(NewYorkCol, 40)) : na

NewYorkLine := halfline ? line.new(x1=bar_index, y1=na, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(NewYorkCol, 40)) : na

NewYorkLabel := showLabels ? label.new(x=na, y=na, text=NewYorkText, textcolor=color.new(NewYorkCol, 40), color=color.rgb(0,0,0,100), size=labelStyle(labelSize)) : na

NewYorkOC := sessionOC ? line.new(x1=bar_index, y1=NewYorkOpenPrice, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(NewYorkCol, 40)) : na

if SydneyStart and showSydney and inRange

SydneyBox := displayType=='Boxes' ? box.new(left=bar_index, top=na, right=na, bottom=na, border_width=borderWidth, bgcolor = colorBoxes ? SydneyCol : na, border_style = lineStyle(borderStyle), border_color=color.new(SydneyCol, 40)) : na

SydneyLine := halfline ? line.new(x1=bar_index, y1=na, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(SydneyCol, 40)) : na

SydneyLabel := showLabels ? label.new(x=na, y=na, text=SydneyText, textcolor=color.new(SydneyCol, 40), color=color.rgb(0,0,0,100), size=labelStyle(labelSize)) : na

SydneyOC := sessionOC ? line.new(x1=bar_index, y1=SydneyOpenPrice, x2=na, y2=na, style=lineStyle(levelsStyle), color = color.new(SydneyCol, 40)) : na

// Creating variables for alternative Sessions Box top and bottom (used for merging sessions)

var float TokyoHighM = 0, var float TokyoLowM = 0, var float LondonHighM = 0, var float LondonLowM = 0, var float NewYorkHighM = 0, var float NewYorkLowM = 0, var float SydneyHighM = 0, var float SydneyLowM = 0

// Updating session boxes during sessions

if inTokyo and inRange

TokyoHighPrice := math.max(TokyoHighPrice, high)

TokyoLowPrice := math.min(TokyoLowPrice, low)

box.set_top(TokyoBox, TokyoHighPrice)

box.set_bottom(TokyoBox, TokyoLowPrice)

box.set_right(TokyoBox, bar_index + 1)

label.set_x(TokyoLabel, (box.get_left(TokyoBox)+box.get_right(TokyoBox))/2)

label.set_y(TokyoLabel, TokyoHighPrice)

if sessionOC

line.set_x2(TokyoOC, bar_index)

line.set_y2(TokyoOC, close)

if halfline

line.set_y1(TokyoLine, (TokyoHighPrice+TokyoLowPrice)/2)

line.set_y2(TokyoLine, (TokyoHighPrice+TokyoLowPrice)/2)

line.set_x2(TokyoLine, bar_index+1)

if merge and not inLondon and showLondon

TokyoHighM := TokyoHighPrice

TokyoLowM := TokyoLowPrice

if merge and inLondon and showLondon

box.set_top(TokyoBox, TokyoHighM)

box.set_bottom(TokyoBox, TokyoLowM)

label.set_y(TokyoLabel, TokyoHighM)

box.set_right(TokyoBox, (box.get_left(LondonBox)))

line.set_x2(TokyoLine, (box.get_left(LondonBox)))

label.set_x(TokyoLabel, (box.get_left(TokyoBox)+box.get_right(TokyoBox))/2)

line.set_x2(TokyoOC, (box.get_left(LondonBox)))

line.set_y2(TokyoOC, LondonOpenPrice)

line.set_y1(TokyoLine, (TokyoHighM+TokyoLowM)/2)

line.set_y2(TokyoLine, (TokyoHighM+TokyoLowM)/2)

var float pips = 0

var float chg = 0

pips := changeType=='Session High/Low' ? ((TokyoHighPrice - TokyoLowPrice) / syminfo.mintick / 10) : ((close - TokyoOpenPrice) / syminfo.mintick / 10)

chg := changeType=='Session Open/Close' ? (100 * (close - TokyoOpenPrice) / TokyoOpenPrice) : ((TokyoHighPrice - TokyoLowPrice) / TokyoLowPrice * 100)

if percentChange and not pipChange

label.set_text(TokyoLabel, str.tostring(TokyoText) + ' (' + str.tostring(chg, format.percent) + ')')

if pipChange and not percentChange

label.set_text(TokyoLabel, str.tostring(TokyoText) + ' (' + str.tostring(pips) + ')')

if percentChange and pipChange

label.set_text(TokyoLabel, str.tostring(TokyoText) + ' ('+ str.tostring(chg, format.percent)+ ' • ' + str.tostring(pips) + ')')

if inLondon and inRange

LondonHighPrice := math.max(LondonHighPrice, high)

LondonLowPrice := math.min(LondonLowPrice, low)

box.set_top(LondonBox, LondonHighPrice)

box.set_bottom(LondonBox, LondonLowPrice)

box.set_right(LondonBox, bar_index+1)

label.set_x(LondonLabel, (box.get_left(LondonBox)+box.get_right(LondonBox))/2)

label.set_y(LondonLabel, LondonHighPrice)

if sessionOC

line.set_x2(LondonOC, bar_index)

line.set_y2(LondonOC, close)

if halfline

line.set_y1(LondonLine, (LondonHighPrice+LondonLowPrice)/2)

line.set_y2(LondonLine, (LondonHighPrice+LondonLowPrice)/2)

line.set_x2(LondonLine, bar_index+1)

if merge and not inNewYork and showNewYork

LondonHighM := LondonHighPrice

LondonLowM := LondonLowPrice

if merge and inNewYork and showNewYork

box.set_top(LondonBox, LondonHighM)

box.set_bottom(LondonBox, LondonLowM)

label.set_y(LondonLabel, LondonHighM)

box.set_right(LondonBox, (box.get_left(NewYorkBox)))

line.set_x2(LondonLine, (box.get_left(NewYorkBox)))

label.set_x(LondonLabel, (box.get_left(LondonBox)+box.get_right(LondonBox))/2)

line.set_x2(LondonOC, (box.get_left(NewYorkBox)))

line.set_y2(LondonOC, NewYorkOpenPrice)

line.set_y1(LondonLine, (LondonHighM+LondonLowM)/2)

line.set_y2(LondonLine, (LondonHighM+LondonLowM)/2)

var float pips = 0

var float chg = 0

pips := changeType=='Session High/Low' ? ((LondonHighPrice - LondonLowPrice) / syminfo.mintick / 10) : ((close - LondonOpenPrice) / syminfo.mintick / 10)

chg := changeType=='Session Open/Close' ? (100 * (close - LondonOpenPrice) / LondonOpenPrice) : ((LondonHighPrice - LondonLowPrice) / LondonLowPrice * 100)

if percentChange and not pipChange

label.set_text(LondonLabel, str.tostring(LondonText) + ' (' + str.tostring(chg, format.percent) + ')')

if pipChange and not percentChange

label.set_text(LondonLabel, str.tostring(LondonText) + ' (' + str.tostring(pips) + ')')

if percentChange and pipChange

label.set_text(LondonLabel, str.tostring(LondonText) + ' ('+ str.tostring(chg, format.percent)+ ' • ' + str.tostring(pips) + ')')

if inNewYork and inRange

NewYorkHighPrice := math.max(NewYorkHighPrice, high)

NewYorkLowPrice := math.min(NewYorkLowPrice, low)

box.set_top(NewYorkBox, NewYorkHighPrice)

box.set_bottom(NewYorkBox, NewYorkLowPrice)

box.set_right(NewYorkBox, bar_index + 1)

label.set_x(NewYorkLabel, (box.get_left(NewYorkBox)+box.get_right(NewYorkBox))/2)

label.set_y(NewYorkLabel, NewYorkHighPrice)

if sessionOC

line.set_x2(NewYorkOC, bar_index)

line.set_y2(NewYorkOC, close)

if halfline

line.set_y1(NewYorkLine, (NewYorkHighPrice+NewYorkLowPrice)/2)

line.set_y2(NewYorkLine, (NewYorkHighPrice+NewYorkLowPrice)/2)

line.set_x2(NewYorkLine, bar_index+1)

if merge and not inSydney and showSydney

NewYorkHighM := NewYorkHighPrice

NewYorkLowM := NewYorkLowPrice

if merge and inSydney and showSydney

box.set_top(NewYorkBox, NewYorkHighM)

box.set_bottom(NewYorkBox, NewYorkLowM)

label.set_y(NewYorkLabel, NewYorkHighM)

box.set_right(NewYorkBox, (box.get_left(SydneyBox)))

line.set_x2(NewYorkLine, (box.get_left(SydneyBox)))

label.set_x(NewYorkLabel, (box.get_left(NewYorkBox)+box.get_right(NewYorkBox))/2)

line.set_x2(NewYorkOC, (box.get_left(SydneyBox)))

line.set_y2(NewYorkOC, SydneyOpenPrice)

line.set_y1(NewYorkLine, (NewYorkHighM+NewYorkLowM)/2)

line.set_y2(NewYorkLine, (NewYorkHighM+NewYorkLowM)/2)

var float pips = 0

var float chg = 0

pips := changeType=='Session High/Low' ? ((NewYorkHighPrice - NewYorkLowPrice) / syminfo.mintick / 10) : ((close - NewYorkOpenPrice) / syminfo.mintick / 10)

chg := changeType=='Session Open/Close' ? (100 * (close - NewYorkOpenPrice) / NewYorkOpenPrice) : ((NewYorkHighPrice - NewYorkLowPrice) / NewYorkLowPrice * 100)

if percentChange and not pipChange

label.set_text(NewYorkLabel, str.tostring(NewYorkText) + ' (' + str.tostring(chg, format.percent) + ')')

if pipChange and not percentChange

label.set_text(NewYorkLabel, str.tostring(NewYorkText) + ' (' + str.tostring(pips) + ')')

if percentChange and pipChange

label.set_text(NewYorkLabel, str.tostring(NewYorkText) + ' ('+ str.tostring(chg, format.percent)+ ' • ' + str.tostring(pips) + ')')

if inSydney and inRange

SydneyHighPrice := math.max(SydneyHighPrice, high)

SydneyLowPrice := math.min(SydneyLowPrice, low)

box.set_top(SydneyBox, SydneyHighPrice)

box.set_bottom(SydneyBox, SydneyLowPrice)

box.set_right(SydneyBox, bar_index + 1)

label.set_x(SydneyLabel, (box.get_left(SydneyBox)+box.get_right(SydneyBox))/2)

label.set_y(SydneyLabel, SydneyHighPrice)

if sessionOC

line.set_x2(SydneyOC, bar_index)

line.set_y2(SydneyOC, close)

if halfline

line.set_y1(SydneyLine, (SydneyHighPrice+SydneyLowPrice)/2)

line.set_y2(SydneyLine, (SydneyHighPrice+SydneyLowPrice)/2)

line.set_x2(SydneyLine, bar_index+1)

if merge and not inTokyo and showTokyo

SydneyHighM := SydneyHighPrice

SydneyLowM := SydneyLowPrice

if merge and inTokyo and showTokyo

box.set_top(SydneyBox, SydneyHighM)

box.set_bottom(SydneyBox, SydneyLowM)

label.set_y(SydneyLabel, SydneyHighM)

box.set_right(SydneyBox, (box.get_left(TokyoBox)))

line.set_x2(SydneyLine, (box.get_left(TokyoBox)))

label.set_x(SydneyLabel, (box.get_left(SydneyBox)+box.get_right(SydneyBox))/2)

line.set_x2(SydneyOC, (box.get_left(TokyoBox)))

line.set_y2(SydneyOC, TokyoOpenPrice)

line.set_y1(SydneyLine, (SydneyHighM+SydneyLowM)/2)

line.set_y2(SydneyLine, (SydneyHighM+SydneyLowM)/2)

var float pips = 0

var float chg = 0

pips := changeType=='Session High/Low' ? ((SydneyHighPrice - SydneyLowPrice) / syminfo.mintick / 10) : ((close - SydneyOpenPrice) / syminfo.mintick / 10)

chg := changeType=='Session Open/Close' ? (100 * (close - SydneyOpenPrice) / SydneyOpenPrice) : ((SydneyHighPrice - SydneyLowPrice) / SydneyLowPrice * 100)

if percentChange and not pipChange

label.set_text(SydneyLabel, str.tostring(SydneyText) + ' (' + str.tostring(chg, format.percent) + ')')

if pipChange and not percentChange

label.set_text(SydneyLabel, str.tostring(SydneyText) + ' (' + str.tostring(pips) + ')')

if percentChange and pipChange

label.set_text(SydneyLabel, str.tostring(SydneyText) + ' ('+ str.tostring(chg, format.percent)+ ' • ' + str.tostring(pips) + ')')

// Coloring candles

TKLO = showLondon ? (not inLondon) : true

LONY = showNewYork ? (not inNewYork) : true

NYSY = showSydney ? (not inSydney) : true

SYTK = showTokyo ? (not inTokyo) : true

barcolor((colorcandles or displayType=='Candles') and not merge and showTokyo and inTokyo and inRange ? color.new(TokyoCol, 40) : na, editable = false)

barcolor((colorcandles or displayType=='Candles') and not merge and showLondon and inLondon and inRange ? color.new(LondonCol, 40) : na, editable = false)

barcolor((colorcandles or displayType=='Candles') and not merge and showNewYork and inNewYork and inRange ? color.new(NewYorkCol, 40) : na, editable = false)

barcolor((colorcandles or displayType=='Candles') and not merge and showSydney and inNewYork and inRange ? color.new(SydneyCol, 40) : na, editable = false)

barcolor((colorcandles or displayType=='Candles') and merge and showTokyo and inTokyo and TKLO and inRange ? color.new(TokyoCol, 40) : na, editable = false)

barcolor((colorcandles or displayType=='Candles') and merge and showLondon and inLondon and LONY and inRange ? color.new(LondonCol, 40) : na, editable = false)

barcolor((colorcandles or displayType=='Candles') and merge and showNewYork and inNewYork and NYSY and inRange ? color.new(NewYorkCol, 40) : na, editable = false)

barcolor((colorcandles or displayType=='Candles') and merge and showSydney and inSydney and SYTK and inRange ? color.new(SydneyCol, 40) : na, editable = false)

// Coloring background if displayType=='Zones'

TokyoT = time(timeframe.period, TokyoTime)

LondonT = time(timeframe.period, LondonTime)

NewYorkT = time(timeframe.period, NewYorkTime)

SydneyT = time(timeframe.period, SydneyTime)

bgcolor(displayType == 'Zones' and not merge and showTokyo and inRange and time == TokyoT ? TokyoCol : na, editable = false)

bgcolor(displayType == 'Zones' and not merge and showLondon and inRange and time == LondonT ? LondonCol : na, editable = false)

bgcolor(displayType == 'Zones' and not merge and showNewYork and inRange and time == NewYorkT ? NewYorkCol : na, editable = false)

bgcolor(displayType == 'Zones' and not merge and showSydney and inRange and time == SydneyT ? SydneyCol : na, editable = false)

bgcolor(displayType == 'Zones' and merge and not inLondon and showTokyo and inRange and time == TokyoT ? TokyoCol : na, editable = false)

bgcolor(displayType == 'Zones' and merge and not inNewYork and showLondon and inRange and time == LondonT ? LondonCol : na, editable = false)

bgcolor(displayType == 'Zones' and merge and not inSydney and showNewYork and inRange and time == NewYorkT ? NewYorkCol : na, editable = false)

bgcolor(displayType == 'Zones' and merge and not inTokyo and showSydney and inRange and time == SydneyT ? SydneyCol : na, editable = false)

// Plotting sessions in Timeline form

plotshape(displayType=='Timeline' and (merge and showLondon ? (showTokyo and inTokyo and not inLondon) : showTokyo and inTokyo), style=shape.square, color=TokyoCol, location = location.bottom, size=size.auto)

plotshape(displayType=='Timeline' and (merge and showNewYork ? (showLondon and inLondon and not inNewYork) : showLondon and inLondon), style=shape.square, color=LondonCol, location = location.bottom, size=size.auto)

plotshape(displayType=='Timeline' and (merge and showSydney ? (showNewYork and inNewYork and not inSydney) : showNewYork and inNewYork), style=shape.square, color=NewYorkCol, location = location.bottom, size=size.auto)

plotshape(displayType=='Timeline' and (merge and showTokyo ? (showSydney and inSydney and not inTokyo) : showSydney and inSydney), style=shape.square, color=SydneyCol, location = location.bottom, size=size.auto)

// Creating alerts

alertcondition(inTokyo and not inTokyo[1], 'Tokyo Open', 'The Tokyo Session has started')

alertcondition(inLondon and not inLondon[1], 'London Open', 'The London Session has started')

alertcondition(inNewYork and not inNewYork[1], 'New York Open', 'The New York Session has started')

alertcondition(inSydney and not inSydney[1], 'Sydney Open', 'The Sydney Session has started')

alertcondition(high > TokyoHighPrice[0] and inTokyo, 'Tokyo Session - New High', 'New High in Tokyo Session')

alertcondition(high > LondonHighPrice[0] and inLondon, 'London Session - New High', 'New High in London Session')

alertcondition(high > NewYorkHighPrice[0] and inNewYork, 'New York Session - New High', 'New High in New York Session')

alertcondition(high > SydneyHighPrice[0] and inSydney, 'Sydney Session - New High', 'New High in Sydney Session')

alertcondition(low > TokyoLowPrice[0] and inTokyo, 'Tokyo Session - New Low', 'New Low in Tokyo Session')

alertcondition(low > LondonLowPrice[0] and inLondon, 'London Session - New Low', 'New Low in London Session')

alertcondition(low > NewYorkLowPrice[0] and inNewYork, 'New York Session - New Low', 'New Low In New York Session')

alertcondition(low > SydneyLowPrice[0] and inSydney, 'Sydney Session - New Low', 'New Low In Sydney Session')

Laporan Volatiliti Harian

Day of Week - Volatility Report

Kod program:

Pine Script

Pengenalan:

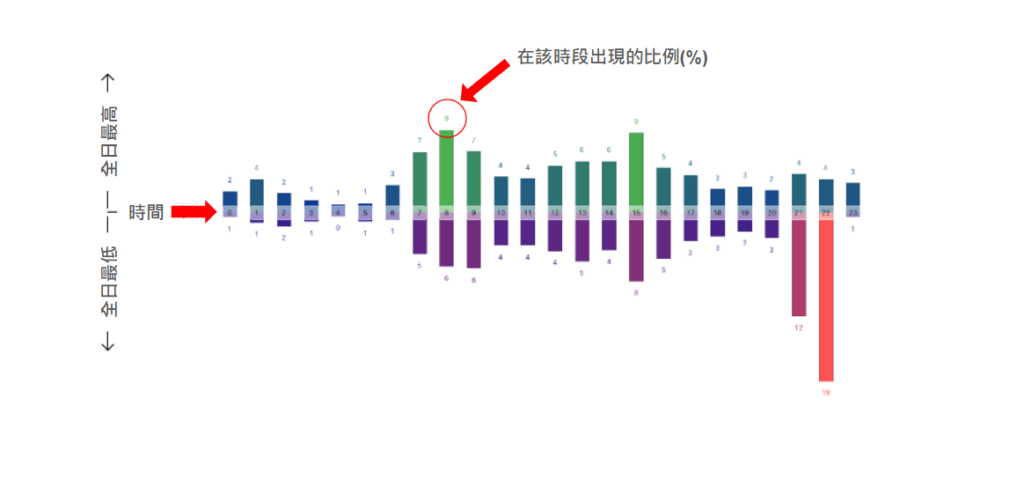

Penunjuk menganalisis turun naik dan melaporkan statistik mengikut hari dalam minggu.

Konsep:

Peserta pasaran yang berbeza mengambil bahagian dalam sesi dagangan yang berbeza. Bagaimanakah ini mempengaruhi pasaran sepanjang minggu?

Berikut ialah beberapa idea untuk diterokai:

Hari dalam minggu manakah pasaran paling tidak menentu?

Tetapkan stop profit dan stop loss dengan merujuk kepada turun naik hari itu.

Adakah terdapat situasi yang bertepatan dengan hari dagangan kemenangan tertinggi?

Apakah hari dalam seminggu anda patut berhenti berdagang?

Soalan-soalan ini melibatkan faktor kompleks peserta pasaran dan keadaan pasaran dan mungkin memerlukan analisis data dan penyelidikan lanjut untuk mendapatkan jawapan yang kukuh. Strategi perdagangan yang berbeza dan selera risiko juga boleh membawa kepada keputusan yang berbeza. Adalah disyorkan agar anda memahami isu-isu ini melalui penyelidikan yang mendalam dan ujian belakang untuk menentukan hari dagangan terbaik untuk strategi dagangan anda.

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © 1uptick

// Last modified: 2023-11-15

// Version 2.0

//@version=5

indicator("Tops & Bottoms - Time of Day Report", format = format.percent, max_labels_count = 72)

//--------------------------------------------------------------------

//#region Constants

//--------------------------------------------------------------------

int COLUMN_WIDTH = 2

int COLUMN_GAP = 2

color COLUMN_BORDERCOLOR = color.new(chart.fg_color, 80)

color COLUMN_TOP_MAX_COLOR = color.green

color COLUMN_TOP_MIN_COLOR = #0c3299

color COLUMN_BOTTOM_MAX_COLOR = color.red

color COLUMN_BOTTOM_MIN_COLOR = #311b92

color CATEGORY_LABEL_BGCOLOR = color.new(chart.bg_color, 50)

color CATEGORY_LABEL_TEXTCOLOR = chart.fg_color

array<string> TIMEFRAMES = array.from("15", "30", "60")

//#endregion

//--------------------------------------------------------------------

//#region Inputs

//--------------------------------------------------------------------

timezoneTooltip = "Exchange and geographical timezones may observe Daylight Saving Time (DST)."

sessionTooltip = "By default, the indicator identifies the top and bottom over the symbol's session. " +

"You can specify your custom session (in the indicator's timezone)."

noticeTitle = "Navigate to the 1-hour timeframe (30-minute timeframe if the market starts at 𝑥:30 AM or " +

"15-minute timeframe if 𝑥:15 AM) for the indicator to analyze the bars and collect tops and bottoms."

timezoneInput = input.string ("Exchange", "Timezone",

[

"UTC",

"Exchange",

"Africa/Cairo",

"Africa/Johannesburg",

"Africa/Lagos",

"Africa/Nairobi",

"Africa/Tunis",

"America/Argentina/Buenos_Aires",

"America/Bogota",

"America/Caracas",

"America/Chicago",

"America/Denver",

"America/El_Salvador",

"America/Juneau",

"America/Lima",

"America/Los_Angeles",

"America/New_York",

"America/Mexico_City",

"America/Phoenix",

"America/Santiago",

"America/Sao_Paulo",

"America/Toronto",

"America/Vancouver",

"Asia/Almaty",

"Asia/Ashgabat",

"Asia/Bahrain",

"Asia/Bangkok",

"Asia/Dubai",

"Asia/Chongqing",

"Asia/Colombo",

"Asia/Ho_Chi_Minh",

"Asia/Hong_Kong",

"Asia/Istanbul",

"Asia/Jakarta",

"Asia/Jerusalem",

"Asia/Karachi",

"Asia/Kathmandu",

"Asia/Kolkata",

"Asia/Kuwait",

"Asia/Manila",

"Asia/Muscat",

"Asia/Nicosia",

"Asia/Qatar",

"Asia/Riyadh",

"Asia/Seoul",

"Asia/Shanghai",

"Asia/Singapore",

"Asia/Taipei",

"Asia/Tehran",

"Asia/Tokyo",

"Asia/Yangon",

"Atlantic/Reykjavik",

"Australia/Adelaide",

"Australia/Brisbane",

"Australia/Perth",

"Australia/Sydney",

"Europe/Amsterdam",

"Europe/Athens",

"Europe/Belgrade",

"Europe/Berlin",

"Europe/Bratislava",

"Europe/Brussels",

"Europe/Bucharest",

"Europe/Budapest",

"Europe/Copenhagen",

"Europe/Dublin",

"Europe/Helsinki",

"Europe/Madrid",

"Europe/Malta",

"Europe/Moscow",

"Europe/Lisbon",

"Europe/London",

"Europe/Luxembourg",

"Europe/Oslo",

"Europe/Paris",

"Europe/Riga",

"Europe/Rome",

"Europe/Stockholm",

"Europe/Tallinn",

"Europe/Vilnius",

"Europe/Warsaw",

"Europe/Zurich",

"Pacific/Auckland",

"Pacific/Chatham",

"Pacific/Fakaofo",

"Pacific/Honolulu",

"Pacific/Norfolk"

],

timezoneTooltip,

display = display.none

)

customSessionInput = input.bool (false, "Custom Session", inline = "Session")

sessionInput = input.session ("0000-0000", "", tooltip = sessionTooltip, inline = "Session", display = display.none)

sessionTypeInput = input.string ("All", "Session", ["All", "Up", "Down"], group = "Filters")

startDateInput = input.time (timestamp("01 Jan 1975"), "From", group = "Filters")

endDateInput = input.time (timestamp("31 Dec 2050"), "To", group = "Filters")

noticeInput = input.bool (true, noticeTitle, group = "How To Use?", confirm = true, display = display.none)

//#endregion

//--------------------------------------------------------------------

//#region Types

//--------------------------------------------------------------------

type Marker

float price = na

int time = na

//#endregion

//--------------------------------------------------------------------

//#region Variables declarations

//--------------------------------------------------------------------

var topsByHourMap = map.new<int, int>()

var bottomsByHourMap = map.new<int, int>()

var openTimesByHourMap = map.new<int, string>()

var closeTimesByHourMap = map.new<int, string>()

var top = Marker.new()

var bottom = Marker.new()

//#endregion

//--------------------------------------------------------------------

//#region Functions & methods

//--------------------------------------------------------------------

// @function Produce the timezone parameter from the user-selected setting.

// @returns (string) Timezone

getTimezone() =>

var _tz = switch timezoneInput

"UTC" => "UTC+0"

"Exchange" => syminfo.timezone

=> timezoneInput

// @function Get the hour in the user-selected timezone from a given UNIX time.

// @returns (int) Hour

getHour(int barTime) =>

hour(barTime, getTimezone())

// @function Get the color based on a gradient between the minimum and maximum values.

// @returns color

getGradientColor(float value, float minValue, float maxValue, color minColor, color maxColor) =>

// When `minValue` and `maxValue` are identical (on the first collected values), return the mid gradient color instead of no color.

minValue != maxValue ? color.from_gradient(value, minValue, maxValue, minColor, maxColor) : color.from_gradient(0.5, 0, 1, minColor, maxColor)

// @function Draw the columns for a given hour.

// @returns void

drawHourlyColumns(int key) =>

var _upperColumnBox = box.new(na, na, na, na, COLUMN_BORDERCOLOR)

var _lowerColumnBox = box.new(na, na, na, na, COLUMN_BORDERCOLOR)

var _upperDataLabel = label.new(na, na, color = color(na), style = label.style_label_down)

var _lowerDataLabel = label.new(na, na, color = color(na), style = label.style_label_up)

var _categoryLabel = label.new(na, na, color = CATEGORY_LABEL_BGCOLOR, style = label.style_label_center, textcolor = CATEGORY_LABEL_TEXTCOLOR)

var _gridMultiplier = COLUMN_WIDTH + COLUMN_GAP

if barstate.islast

_topsArray = topsByHourMap.values()

_bottomsArray = bottomsByHourMap.values()

// Sum the number of data sampled.

_dataSum = _topsArray.sum()

// Calculate the shares of occurrence of tops and bottoms.

_top = topsByHourMap.get(key)

_bottom = bottomsByHourMap.get(key)

_topY = nz(_top / _dataSum * 100)

_bottomY = nz(_bottom / _dataSum * 100)

// Get the coordinates for plotting the columns chart (on the left or right side of the last bar, given enough space).

_hasSpace = bar_index - 24 * _gridMultiplier > 0

_x1 = _hasSpace ? bar_index + (key - 24) * _gridMultiplier : bar_index + key * _gridMultiplier

_x2 = _x1 + COLUMN_WIDTH

_center = _x1 + COLUMN_WIDTH / 2

// Get the coloring of the columns and data labels.

_topsMin = _topsArray.min() / _dataSum * 100

_topsMax = _topsArray.max() / _dataSum * 100

_bottomsMin = _bottomsArray.min() / _dataSum * 100

_bottomsMax = _bottomsArray.max() / _dataSum * 100

_topColor = getGradientColor(_topY, _topsMin, _topsMax, COLUMN_TOP_MIN_COLOR, COLUMN_TOP_MAX_COLOR)

_bottomColor = getGradientColor(_bottomY, _bottomsMin, _bottomsMax, COLUMN_BOTTOM_MIN_COLOR, COLUMN_BOTTOM_MAX_COLOR)

// Plot the upper and lower columns for tops and bottoms.

_upperColumnBox.set_lefttop (_x1, _topY)

_upperColumnBox.set_rightbottom (_x2, 0)

_upperColumnBox.set_bgcolor (_topColor)

_lowerColumnBox.set_lefttop (_x1, 0)

_lowerColumnBox.set_rightbottom (_x2, -_bottomY)

_lowerColumnBox.set_bgcolor (_bottomColor)

// Plot the X-axis category label.

_openTime = openTimesByHourMap.get(key)

_closeTime = closeTimesByHourMap.get(key)

_isCategoryDefined = not (na(_openTime) or na(_closeTime))

_categoryLabel.set_xy (_center, 0)

_categoryLabel.set_text (str.tostring(key))

_categoryLabel.set_tooltip (_isCategoryDefined ? str.format("{0} to {1} ({2})", _openTime, _closeTime, getTimezone()) : "Not Collected")

// Plot the data labels for tops and bottoms.

if not na(_top)

_upperDataLabel.set_xy (_center, _topY)

_upperDataLabel.set_text (str.tostring(math.round(_topY)))

_upperDataLabel.set_textcolor (_topColor)

_upperDataLabel.set_tooltip (str.format("{0} based on {1} sampled days", str.tostring(_topY, format.percent), _dataSum))

if not na(_bottom)

_lowerDataLabel.set_xy (_center, -_bottomY)

_lowerDataLabel.set_text (str.tostring(math.round(_bottomY)))

_lowerDataLabel.set_textcolor (_bottomColor)

_lowerDataLabel.set_tooltip (str.format("{0} based on {1} sampled days", str.tostring(_bottomY, format.percent), _dataSum))

// @function Check if the day/custom session matches the user-selected session type filter.

// @returns bool

isValidSessionType(start, end) =>

var float _open = na

bool _isValid = na

if start

_open := open

if end

_isValid := switch sessionTypeInput

"All" => not na(_open[1])

"Up" => close[1] > _open[1]

"Down" => close[1] < _open[1]

_isValid

// @function Check if the current bar time is in the user-selected time range filter.

// @returns bool

isInTimeRange() =>

time >= startDateInput and time <= endDateInput

// @function Produce the UNIX time of the current date at a specified time in the user-selected timezone.

// @returns (int) UNIX time

getTime(int h, int m) =>

timestamp(getTimezone(), year, month, dayofmonth, h, m, second)

// @function Get the current day's session dates from a given session string.

// @returns ([int, int]) Start and end UNIX time

getSessionTimes(sessionString) =>

[getTime(int(str.tonumber(str.substring(sessionString, 0, 2))), int(str.tonumber(str.substring(sessionString, 2, 4)))),

getTime(int(str.tonumber(str.substring(sessionString, 5, 7))), int(str.tonumber(str.substring(sessionString, 7))))]

// @function Detect changes in the day/custom session and if the current bar is in the session.

// @returns [bool, bool, bool]

sessionChange() =>

if customSessionInput

var int _startTime = na

var int _endTime = na

_isInSession = not na(time(timeframe.period, sessionInput, getTimezone()))

[_currentStartTime, _currentEndTime] = getSessionTimes(sessionInput)

// On overnight sessions (e.g., EURUSD), preserve original start and end times.

_startTime := time >= _currentStartTime ? _currentStartTime : _startTime

_endTime := time >= _currentEndTime ? _currentEndTime : _endTime

// Start on the first bar of the session.

_start = ta.change(_startTime) > 0 and _isInSession

// End after the last bar of the session.

_end = ta.change(_endTime) > 0 and _isInSession[1]

[_start, _end, _isInSession]

else

// Start and end on the day change.

_dayChange = timeframe.change("D")

[_dayChange, _dayChange, true]

//#endregion

//--------------------------------------------------------------------

//#region Logic

//--------------------------------------------------------------------

if TIMEFRAMES.indexof(timeframe.period) == -1

runtime.error("The report can not compute data on the chart's timeframe. Please navigate to the 1-hour, 30-minute, or 15-minute timeframe.")

//@variable Is true when the current bar is inside the time range filter.

isInRange = isInTimeRange()

// Session variables from the day/custom session.

[sessionStart, sessionEnd, isInSession] = sessionChange()

// @variable Is true when the day/custom session closes per the session type filter.

isValidType = isValidSessionType(sessionStart, sessionEnd)

// Track the top and bottom of the day/custom session.

if isInRange

// Reset the top and bottom on the first bar of a new day/custom session.

if sessionStart

top.price := na

top.time := na

bottom.price := na

bottom.time := na

// Track the top and bottom.

if na(top.price) or high > top.price

top.price := high

top.time := time

if na(bottom.price) or low < bottom.price

bottom.price := low

bottom.time := time

// Collect the top, bottom, and time data.

if isInRange and barstate.isconfirmed

// @variable Is true on the first bar of the time range.

_isFirstBar = na(top.time[1]) or na(bottom.time[1])

// Collect the top and bottom on matching type on a day/custom session change.

if isValidType and not _isFirstBar

_topHour = getHour(top.time[1])

_bottomHour = getHour(bottom.time[1])

_topCount = nz(topsByHourMap.get(_topHour)) +1

_bottomCount = nz(bottomsByHourMap.get(_bottomHour)) +1

topsByHourMap.put (_topHour, _topCount)

bottomsByHourMap.put(_bottomHour, _bottomCount)

log.info("\n▲ Top at {0} ({1}/{4})\n▼ Bottom at {2} ({3}/{4})", _topHour, _topCount, _bottomHour, _bottomCount, topsByHourMap.values().sum())

// Collect the hourly opening and closing times

// On hourly time change, collect the open time and preceding close time.

// The times are be displayed in the tooltips of category labels.

_barHour = getHour(time)

_prevBarHour = getHour(time[1])

if _prevBarHour != _barHour

openTimesByHourMap.put (_barHour, str.format_time(time, "HH:mm", getTimezone()))

closeTimesByHourMap.put(_prevBarHour, str.format_time(time_close[1], "HH:mm", getTimezone()))

//#endregion

//--------------------------------------------------------------------

//#region Visuals

//--------------------------------------------------------------------

drawHourlyColumns(0)

drawHourlyColumns(1)

drawHourlyColumns(2)

drawHourlyColumns(3)

drawHourlyColumns(4)

drawHourlyColumns(5)

drawHourlyColumns(6)

drawHourlyColumns(7)

drawHourlyColumns(8)

drawHourlyColumns(9)

drawHourlyColumns(10)

drawHourlyColumns(11)

drawHourlyColumns(12)

drawHourlyColumns(13)

drawHourlyColumns(14)

drawHourlyColumns(15)

drawHourlyColumns(16)

drawHourlyColumns(17)

drawHourlyColumns(18)

drawHourlyColumns(19)

drawHourlyColumns(20)

drawHourlyColumns(21)

drawHourlyColumns(22)

drawHourlyColumns(23)

//#endregion

Sokongan dan rintangan carta

Support and Resistnace

Kod program:

Pine Script

Pengenalan:

Revolusikan pengalaman dagangan anda di TradingView! Alat ini berfungsi pada tiga rangka masa yang berbeza, memberikan pandangan menyeluruh tentang dinamik pasaran, mengenal pasti rintangan dan sokongan pada carta, dan membantu anda membuat keputusan perdagangan termaklum.

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @1uptick

//@version=5

const bool DEBUG = false

indicator("1up Support & Resistance", overlay = true, max_labels_count = 100, max_lines_count = 100, max_boxes_count = 100, max_bars_back = 305)

const int timeframeCount = 3

const float labelOffsetsY = 1.001

const int labelOffsetsXIndex = 30

const float epsilon = 0.001

const float retestEpsilon = 0.002

const int maxPivotsBackSR = 15

const int retestLabelEveryXBars = 4

const int maxTraverse = 200 // Affects bar history limit. Default value 200.

const int maxRetestLabels = 25

const int maxSupports = 3

const int maxResistances = 3

const float retestPriceDifferencePercentMax = 0.02

const bool calculateTimeSkipMS = false

const int debug_maxPivotLabels = 25

// _____ INPUTS _____

resistanceSupportCount = input.int(3, "Support & Resistance Count", options = [1, 2, 3], group = "General Configuration")

pivotRange = input.int(15, "Pivot Range", options = [5, 15, 30], tooltip = "Increase for more general pivots, decrease for more private pivots.", group = "General Configuration")

strength = input.int(1, "Strength", options = [1, 2, 3, 4], tooltip = "X many times price touched relative price area in order to be considered a support/resistance zone.", group = "General Configuration")

expandLines = input.bool(true,"Expand Lines & Zones", group = "General Configuration")

enableZones = input.bool(false, "Enable Zones", group = "Support & Resistance Zones")

zoneWidth = input.int(1, "Zone Width", options = [1,2,3], group = "Support & Resistance Zones")

timeframe1Enabled = input.bool(true, title = "", group = "Timeframes", inline = "timeframe1")

timeframe1 = input.timeframe("", title = "", group = "Timeframes", inline = "timeframe1")

timeframe2Enabled = input.bool(false, title = "", group = "Timeframes", inline = "timeframe2")

timeframe2 = input.timeframe("15", title = "", group = "Timeframes", inline = "timeframe2")

timeframe3Enabled = input.bool(false, title = "", group = "Timeframes", inline = "timeframe3")

timeframe3 = input.timeframe("30", title = "", group = "Timeframes", inline = "timeframe3")

showBreaks = input.bool(true,"Show Breaks", group = "Breaks & Retests", inline = "ShowBR")

showRetests = input.bool(true,"Show Retests", group = "Breaks & Retests", inline = "ShowBR")

avoidFalseBreaks = input.bool(true,"Avoid False Breaks", group = "Breaks & Retests")

falseBreakoutVolumeThreshold = input.int(30, "Break Volume Threshold %", minval = 0, maxval = 100, group = "Breaks & Retests", tooltip = "Only taken into account if Avoid False Breakouts is enabled.\nHigher values mean it's less likely to be a break.")

inverseBrokenLineColor = input.bool(false,"Inverse Color After Broken", tooltip = "Needs Show Breaks & Expand Lines option enabled.", group = "Breaks & Retests")

lineStyle = input.string("Solid", "Line Style", ["Solid", "Dashed", "Dotted"], group = "Style")

lineWidth = input.int(2, "Line Width", minval = 1, group = "Style")

supportColor = input.color(#08998180, "Support Color", group = "Style", inline = "RScolors")

resistanceColor = input.color(#f2364580, "Resistance Color", group = "Style", inline = "RScolors")

textColor = input.color(#ffffff80, "Text Color", group = "Style", inline = "RScolors")

enableRetestAlerts = input.bool(true, "Enable Retest Alerts", tooltip = "Needs Show Retests option enabled.", group = "Alerts")

enableBreakAlerts = input.bool(true, "Enable Break Alerts", group = "Alerts")

memoryOptimizatonEnabled = input.bool(false, "Enable Memory Optimization", tooltip = "Enable this option if you encounter memory errors.", group = "Advanced")

// _____ INPUTS END _____

// _____ DEBUG OPTIONS _____

debug_labelPivots = not DEBUG ? "None" : input.string("None", title = "[DBG] Label Pivots", group = "DEBUG", options = ["All", "RS", "None"], tooltip = "All -> Debugs all pivot labels.\nRS -> Debugs RS pivot labels.\nNone -> Debugs none of the last R&S pivots.")

debug_pivotLabelText = not DEBUG ? false : input.bool(false, title = "[DBG] Pivot Label Text", group = "DEBUG")

debug_showBrokenOnLabel = not DEBUG ? false : input.bool(false, "[DBG] Show Broken Text On Label", group = "DEBUG")

debug_removeDuplicateRS = not DEBUG ? true : input.bool(true, "[DBG] Remove Duplicate RS", group = "DEBUG")

debug_lastXResistances = not DEBUG ? 3 : input.int(3, "[DBG] Show Last X Resistances", minval = 0, maxval = maxResistances, group = "DEBUG")

debug_lastXSupports = not DEBUG ? 3 : input.int(3, "[DBG] Show Last X Supports", minval = 0, maxval = maxSupports, group = "DEBUG")

debug_enabledHistory = not DEBUG ? true : input.bool(true, "[DBG] Enable History", group = "DEBUG")

debug_maxHistoryRecords = not DEBUG ? 10 : input.int(10, "[DBG] Max History Records", options = [1, 2, 5, 10, 25], group = "DEBUG")

// _____ DEBUG OPTIONS END _____

createRSLine (color) =>

line.new(na, na, na, na, extend = expandLines ? extend.both : extend.none, xloc=xloc.bar_time, color = color, width = lineWidth, style = lineStyle == "Dashed" ? line.style_dashed : lineStyle == "Dotted" ? line.style_dotted : line.style_solid)

createRSBox (color, xlocType) =>

box.new(na, na, na, na, text_size = size.normal, xloc = xlocType, extend = extend.both, bgcolor = color, text_color = textColor, text_halign = expandLines ? text.align_right : text.align_center, border_color = #00000000)

createRSLabel () =>

label.new(na, na, "", style = label.style_none, textcolor = textColor)

createBreakLabel (RSType) =>

label.new(na,na,"B",style = RSType == "Resistance" ? label.style_label_up : label.style_label_down, color=color.blue, textcolor = color.white, xloc = xloc.bar_time, size = size.small)

createRetestLabel (RSType) =>

label.new(na,na,"R",style = RSType == "Resistance" ? label.style_label_down : label.style_label_up, color = RSType == "Resistance" ? resistanceColor : supportColor, textcolor = color.white, xloc = xloc.bar_time, size = size.small)

moveLine(_line, _x, _y, _x2) =>

line.set_xy1(_line, _x, _y)

line.set_xy2(_line, _x2, _y)

moveBox (_box, _topLeftX, _topLeftY, _bottomRightX, _bottomRightY) =>

box.set_lefttop(_box, _topLeftX, _topLeftY)

box.set_rightbottom(_box, _bottomRightX, _bottomRightY)

moveRSInfoBox (_box, _startPointX, _price, _endPointX) =>

zoneWidthPercent = zoneWidth == 1 ? 0.05 : zoneWidth == 2 ? 0.06 : 0.075

topY = _price * (1.0 + (zoneWidthPercent / 2.0 / 100.0))

bottomY = _price * (1.0 - (zoneWidthPercent / 2.0 / 100.0))

moveBox(_box, _startPointX, topY, _endPointX, bottomY)

// _____ TYPES _____

type RSInfo

bool isBroken = na

int brokenTime = na

string RSType = na

float price = na

line line = na

box box = na

label priceLabel = na

chart.point[] points = na

label[] debugPoints = na

label breakLabel = na

label[] retestLabels = na

line breakLine = na

box breakBox = na

newRSInfo (RSType) =>

newRSInfo = RSInfo.new()

newRSInfo.RSType := RSType

newRSInfo.price := na

newRSInfo.isBroken := false

newRSInfo.brokenTime := na

newRSInfo.line := enableZones ? na : createRSLine(RSType == "Resistance" ? resistanceColor : supportColor)

newRSInfo.box := enableZones ? createRSBox(RSType == "Resistance" ? resistanceColor : supportColor, xloc.bar_time) : na

newRSInfo.priceLabel := enableZones ? na : createRSLabel()

newRSInfo.points := array.new<chart.point>(0)

newRSInfo.debugPoints := array.new<label>(0)

newRSInfo.retestLabels := array.new<label>(0)

newRSInfo.breakLabel := na

newRSInfo.breakLine := na

newRSInfo.breakBox := na

newRSInfo

histRSInfo (RSInfo RSInfoF) =>

RSType = RSInfoF.RSType

newRS = RSInfo.new()

newRS.RSType := RSType

newRS.price := RSInfoF.price

newRS.debugPoints := array.new<label>(0)

newRS.retestLabels := array.new<label>(0)

newRS.points := array.new<chart.point>(0)

histText = "History | " + str.tostring(newRS.price, format.mintick)

startTime = math.min(time, RSInfoF.points.get(strength - 1).time)

endTime = RSInfoF.isBroken ? RSInfoF.brokenTime : time

if enableZones

newRS.box := createRSBox(RSType == "Resistance" ? resistanceColor : supportColor, xloc.bar_time)

moveRSInfoBox(newRS.box, startTime, newRS.price, endTime)

box.set_extend(newRS.box, expandLines ? extend.both : extend.none)

box.set_text(newRS.box, histText)

else

newRS.line := line.copy(RSInfoF.line)

moveLine(newRS.line, startTime, newRS.price, endTime)

line.set_extend(newRS.line, expandLines ? extend.both : extend.none)

newRS.priceLabel := label.copy(RSInfoF.priceLabel)

label.set_text(newRS.priceLabel, histText)

label.set_xloc(newRS.priceLabel, (startTime + endTime) / 2, xloc.bar_time)

if not na(newRS.breakLabel)

newRS.breakLabel := label.copy(RSInfoF.breakLabel)

newRS

safeDeleteRSInfo (RSInfo RSInfoF) =>

if not na(RSInfoF)

line.delete(RSInfoF.line)

box.delete(RSInfoF.box)

label.delete(RSInfoF.priceLabel)

RSInfoF.points.clear()

if RSInfoF.debugPoints.size() > 0

for i = 0 to RSInfoF.debugPoints.size() - 1

label.delete(RSInfoF.debugPoints.get(i))

RSInfoF.debugPoints.clear()

if RSInfoF.retestLabels.size() > 0

for i = 0 to RSInfoF.retestLabels.size() - 1

label.delete(RSInfoF.retestLabels.get(i))

RSInfoF.retestLabels.clear()

label.delete(RSInfoF.breakLabel)

line.delete(RSInfoF.breakLine)

box.delete(RSInfoF.breakBox)

type timeframeInfo

int index = na

string timeframeStr = na

bool isEnabled = false

RSInfo[] resistances = na

RSInfo[] supports = na

float[] highPivots = na

int[] highTimes = na

float[] lowPivots = na

int[] lowTimes = na

newTimeframeInfo (index, timeframeStr, isEnabled) =>

newTFInfo = timeframeInfo.new()

newTFInfo.index := index

newTFInfo.isEnabled := isEnabled

newTFInfo.timeframeStr := timeframeStr

newTFInfo.resistances := array.new<RSInfo>(debug_lastXResistances)

newTFInfo.supports := array.new<RSInfo>(debug_lastXSupports)

newTFInfo.highPivots := array.new<float>()

newTFInfo.highTimes := array.new<int>()

newTFInfo.lowPivots := array.new<float>()

newTFInfo.lowTimes := array.new<int>()

newTFInfo

// _____ TYPES END _____

// _____ VARS _____

var timeframeInfo[] timeframeInfos = array.from(newTimeframeInfo(1, timeframe1, timeframe1Enabled), newTimeframeInfo(2, timeframe2, timeframe2Enabled), newTimeframeInfo(3, timeframe3, timeframe3Enabled))

var bool initRun = true

var int maxTimeskipMS = 0

var float[] allLowPivots = array.new<float>(0)

var float[] allHighPivots = array.new<float>(0)

var int[] allLowTimes = array.new<int>(0)

var int[] allHighTimes = array.new<int>(0)

var RSInfo[] history = array.new<RSInfo>(0)

RSInfo[] curRSList = array.new<RSInfo>(0)

RSInfo[] oldRSList = array.new<RSInfo>(0)

int maxPivotsAllowed = memoryOptimizatonEnabled ? 10 : 15 // Affects memory limit. Default value 30.

// _____ VARS END _____

doValuesTouch (float value1, float value2) =>

if math.abs(value1 - value2) / ((value1 + value2) / 2.0) <= epsilon

true

else

false

doValuesTouch (float value1, float value2, float customEpsilon) =>

if math.abs(value1 - value2) / ((value1 + value2) / 2.0) <= customEpsilon

true

else

false

findLatestRS (timeframeInfo timeframeInfoF, string RSType, pivots, times, bannedValues) =>

RSInfo latestRSF = na

pivotsCount = pivots.size()

if pivotsCount > 0

for i = 0 to pivotsCount - 1

if i >= maxTraverse

break

index = pivotsCount - i - 1

occurances = 0

invalidValue = false

pivotValue1 = pivots.get(index)

if bannedValues.size() > 0

for a = 0 to bannedValues.size() - 1

if doValuesTouch(pivotValue1, bannedValues.get(a))

invalidValue := true

break

if invalidValue

continue

for j = 0 to pivotsCount - 1

if j >= maxTraverse

break

index2 = pivotsCount - j - 1

pivotValue2 = pivots.get(index2)

if doValuesTouch(pivotValue1, pivotValue2)

occurances += 1

if occurances >= strength

latestRSF := newRSInfo(RSType)

latestRSF.price := pivotValue1

break

if math.abs(index - index2) > maxPivotsBackSR * strength

break

if not na(latestRSF)

break

if not na(latestRSF)

cnt = 0

if pivotsCount > 0

for i = 0 to pivotsCount - 1

if i >= maxTraverse

break

index = pivotsCount - i - 1

pivotValue = pivots.get(index)

if doValuesTouch(pivotValue, latestRSF.price)

labelTime = times.get(index)

latestRSF.points.push(chart.point.from_time(labelTime, pivotValue))

cnt += 1

if cnt == strength

break

if not (debug_labelPivots == "None")

if not (debug_labelPivots == "All")

if not na(latestRSF)

cnt = 0

if pivotsCount > 0

for i = 0 to pivotsCount - 1

index = pivotsCount - i - 1

pivotValue = pivots.get(index)

if doValuesTouch(pivotValue, latestRSF.price)

labelTime = times.get(index)

latestRSF.debugPoints.push(RSType == "Resistance" ? label.new(labelTime,pivotValue,text=debug_pivotLabelText ? str.tostring(pivotValue) : "",xloc=xloc.bar_time, color=resistanceColor, textcolor=color.white) : label.new(labelTime,pivotValue,text=debug_pivotLabelText ? str.tostring(pivotValue) : "",xloc=xloc.bar_time, color=supportColor,style = label.style_label_up, textcolor=color.white))

cnt += 1

if cnt == strength

break

else

if not na(latestRSF)

if pivotsCount > 0

for i = 0 to pivotsCount - 1

index = pivotsCount - i - 1

pivotValue = pivots.get(index)

labelTime = times.get(index)

latestRSF.debugPoints.push(RSType == "Resistance" ? label.new(labelTime,pivotValue,text=debug_pivotLabelText ? str.tostring(pivotValue) : "",xloc=xloc.bar_time, color=resistanceColor, textcolor=color.white) : label.new(labelTime,pivotValue,text=debug_pivotLabelText ? str.tostring(pivotValue) : "",xloc=xloc.bar_time, color=supportColor,style = label.style_label_up, textcolor=color.white))

if latestRSF.debugPoints.size() > debug_maxPivotLabels

break

latestRSF

findLatestNthRS (timeframeInfo timeframeInfoF, string RSType, pivots, times, n) =>

float[] bannedValues = array.new<float>()

foundRS = 0

RSInfo foundLatestRS = na

while foundRS < n

foundLatestRS := findLatestRS(timeframeInfoF, RSType, pivots, times, bannedValues)

if not na(foundLatestRS)

foundRS += 1

bannedValues.push(foundLatestRS.price)

else

break

foundLatestRS

isTimeframeLower (timeframe1F, timeframe2F) =>

timeframe.in_seconds(timeframe1F) < timeframe.in_seconds(timeframe2F)

getMinTimeframe (timeframe1F, timeframe2F) =>

if isTimeframeLower(timeframe1F, timeframe2F)

timeframe1F

else

timeframe2F

getMaxTimeframe (timeframe1F, timeframe2F) =>

if isTimeframeLower(timeframe1F, timeframe2F)

timeframe2F

else

timeframe1F

getFirstBreak (RSInfo rsInfo) =>

if na(rsInfo)

[na, na]

curIndex = 0

float foundBreakLevel = na

int foundBreakTime = na

while true

if curIndex >= maxTraverse

break

isBarBreak = rsInfo.RSType == "Resistance" ? (close[curIndex + 1] <= rsInfo.price and close[curIndex] > rsInfo.price) : (close[curIndex + 1] >= rsInfo.price and close[curIndex] < rsInfo.price)

if isBarBreak

isTrueBreakout = true

if avoidFalseBreaks

shortTerm = 5

longTerm = 15

shortSum = 0.0

longSum = 0.0

for i = 0 to shortTerm

shortSum += volume[curIndex + i]

for i = 0 to longTerm

longSum += volume[curIndex + i]

shortVolumeAvg = shortSum / shortTerm

longVolumeAvg = longSum / longTerm

volumeRatio = ((shortVolumeAvg - longVolumeAvg) / longVolumeAvg) * 100.0

isTrueBreakout := (volumeRatio >= falseBreakoutVolumeThreshold)

if isTrueBreakout

foundBreakLevel := rsInfo.RSType == "Resistance" ? low[curIndex] : high[curIndex]

foundBreakTime := time[curIndex]

curIndex += 1

if time[curIndex] <= rsInfo.points.get(strength - 1).time

break

[foundBreakLevel, foundBreakTime]

getRetests (RSInfo rsInfo) =>

if na(rsInfo)

[na,na]

curIndex = 0

lastRetestIndex = -999

int[] retestTimes = array.new<int>()

float[] retestLevels = array.new<float>()

while true

if curIndex >= maxTraverse

break

if retestLevels.size() == maxRetestLabels

break

if rsInfo.isBroken and time[curIndex] >= rsInfo.brokenTime

curIndex += 1

continue

differencePercent = 100.0 * math.abs(rsInfo.price - close[curIndex]) / ((rsInfo.price + close[curIndex]) / 2)

isRetest = (rsInfo.RSType == "Resistance" ? (doValuesTouch(rsInfo.price, close[curIndex], retestEpsilon) or doValuesTouch(rsInfo.price, high[curIndex], retestEpsilon) or high[curIndex] > rsInfo.price) : (doValuesTouch(rsInfo.price, close[curIndex], retestEpsilon) or doValuesTouch(rsInfo.price, low[curIndex], retestEpsilon) or low[curIndex] < rsInfo.price)) and differencePercent < retestPriceDifferencePercentMax

if isRetest and curIndex - lastRetestIndex >= retestLabelEveryXBars

retestLevels.push(rsInfo.RSType == "Resistance" ? high[curIndex] : low[curIndex])

retestTimes.push(time[curIndex])

lastRetestIndex := curIndex

curIndex += 1

if time[curIndex] <= rsInfo.points.get(strength - 1).time

break

[retestLevels, retestTimes]

formatTimeframeString (formatTimeframe) =>

timeframeF = formatTimeframe == "" ? timeframe.period : formatTimeframe

if str.contains(timeframeF, "D") or str.contains(timeframeF, "W") or str.contains(timeframeF, "S") or str.contains(timeframeF, "M")

timeframeF

else

seconds = timeframe.in_seconds(timeframeF)

if seconds >= 3600

hourCount = int(seconds / 3600)

str.tostring(hourCount) + " Hour" + (hourCount > 1 ? "s" : "")

else

timeframeF + " Min"

getPivot (pivotType) =>

pivot = (pivotType == "high" ? ta.pivothigh(high, pivotRange, pivotRange) : ta.pivotlow(low, pivotRange, pivotRange))

pivot

handleRSInfo (timeframeInfo timeframeInfoF, RSInfo RSInfoF, int index, string RSType) =>

if not na(RSInfoF)

if not na(timeframeInfoF)

curRSList.push(RSInfoF)

[foundBreakLevel, foundBreakTime] = getFirstBreak(RSInfoF)

RSInfoF.isBroken := na(foundBreakLevel) ? false : true

RSInfoF.brokenTime := na(foundBreakLevel) ? na : foundBreakTime

if not na(foundBreakLevel)

if showBreaks

if na(RSInfoF.breakLabel)

RSInfoF.breakLabel := createBreakLabel(RSInfoF.RSType)

label.set_xy(RSInfoF.breakLabel, foundBreakTime, foundBreakLevel * (RSInfoF.RSType == "Resistance" ? (1.0 / labelOffsetsY) : labelOffsetsY))

if expandLines

if na(RSInfoF.breakLine) and enableZones == false

RSInfoF.breakLine := createRSLine(color.black)

if na(RSInfoF.breakBox) and enableZones == true

RSInfoF.breakBox := createRSBox(color.black, xloc.bar_time)

if not enableZones

line.set_extend(RSInfoF.breakLine, extend.right)

else

box.set_extend(RSInfoF.breakBox, extend.right)

if inverseBrokenLineColor and showBreaks

if not enableZones

line.set_color(RSInfoF.breakLine, RSInfoF.RSType == "Resistance" ? supportColor : resistanceColor)

else

box.set_bgcolor(RSInfoF.breakBox, RSInfoF.RSType == "Resistance" ? supportColor : resistanceColor)

else

if not enableZones

line.set_color(RSInfoF.breakLine, RSInfoF.RSType == "Resistance" ? resistanceColor : supportColor)

else

box.set_bgcolor(RSInfoF.breakBox, RSInfoF.RSType == "Resistance" ? resistanceColor : supportColor)

if showRetests

[retestLevels, retestTimes] = getRetests(RSInfoF)

if not na(retestLevels) and retestLevels.size() > 0

for i = 0 to retestLevels.size() - 1

newRetestLabel = createRetestLabel(RSInfoF.RSType)

label.set_xy(newRetestLabel, retestTimes.get(i), retestLevels.get(i) * (RSInfoF.RSType == "Support" ? (1.0 / labelOffsetsY) : labelOffsetsY))

RSInfoF.retestLabels.push(newRetestLabel)

//timeSkipOffset = maxTimeskipMS / 4

timeSkipOffset = 0

if enableZones

zoneEndX = time + timeSkipOffset + timeframe.in_seconds(timeframe.period) * 1000 * labelOffsetsXIndex

startTime = math.min(time, RSInfoF.points.get(strength - 1).time)

moveRSInfoBox(RSInfoF.box, startTime, RSInfoF.price, na(foundBreakTime) ? zoneEndX : foundBreakTime)

moveRSInfoBox(RSInfoF.breakBox, foundBreakTime, RSInfoF.price, zoneEndX)

else

endTime = time + timeSkipOffset + timeframe.in_seconds(timeframe.period) * 1000

startTime = math.min(time, RSInfoF.points.get(strength - 1).time)

moveLine(RSInfoF.line, startTime, RSInfoF.price, na(foundBreakTime) ? endTime : foundBreakTime)

moveLine(RSInfoF.breakLine, foundBreakTime, RSInfoF.price, endTime)

//log.info(str.tostring(RSInfoF.price) + " | " + str.tostring(RSInfoF.points.get(strength - 1).time) + " = " + str.tostring(line.get_x1(RSInfoF.line)) + " | " + str.tostring(endTime) + " = " + str.tostring(line.get_x2(RSInfoF.line)))

if expandLines

if not enableZones

line.set_extend(RSInfoF.line, (na(foundBreakTime)) ? extend.both : extend.left)

else

box.set_extend(RSInfoF.box, (na(foundBreakTime)) ? extend.both : extend.left)

else

if not enableZones

line.set_extend(RSInfoF.line, na(foundBreakTime) ? extend.right : extend.none)

else

box.set_extend(RSInfoF.box, na(foundBreakTime) ? extend.right : extend.none)

//labelTitleOld = formatTimeframeString(timeframeInfoF.timeframeStr) + " " + RSInfoF.RSType + " " + str.tostring(index + 1) + " (" + str.tostring(RSInfoF.price,format.mintick) + ")" + (RSInfoF.isBroken ? " [Broken]" : "")

labelTitle = formatTimeframeString(timeframeInfoF.timeframeStr) + " | " + str.tostring(RSInfoF.price,format.mintick) + ((debug_showBrokenOnLabel and RSInfoF.isBroken) ? " [B]" : "")

if not enableZones

label.set_text(RSInfoF.priceLabel, enableZones ? "" : labelTitle)

label.set_y(RSInfoF.priceLabel, RSInfoF.price)

else

box.set_text(RSInfoF.box, (RSInfoF.isBroken and expandLines) ? "" : labelTitle)

box.set_text(RSInfoF.breakBox, labelTitle)

if expandLines or not RSInfoF.isBroken

if not enableZones

label.set_xloc(RSInfoF.priceLabel, bar_index + labelOffsetsXIndex, xloc.bar_index)

else

box.set_text_halign(RSInfoF.breakBox, text.align_right)

box.set_text_halign(RSInfoF.box, text.align_right)

else

if not enableZones

label.set_xloc(RSInfoF.priceLabel, (RSInfoF.points.get(strength - 1).time + RSInfoF.brokenTime) / 2, xloc.bar_time)

else

box.set_text_halign(RSInfoF.box, text.align_center)

box.set_text_halign(RSInfoF.breakBox, text.align_center)

else

log.error("Couldn't find timeframe " + str.tostring(timeframeInfoF.index) + " " + str.tostring(index + 1) + "th " + RSType + " . Try decreasing pivot range in the settings.")

handleTimeframe (timeframeIndex, lowPivots, highPivots, lowTimes, highTimes) =>

timeframeInfoF = timeframeInfos.get(timeframeIndex - 1)

timeframeInfoF.lowPivots.clear()

timeframeInfoF.highPivots.clear()

timeframeInfoF.lowTimes.clear()

timeframeInfoF.highTimes.clear()

timeframeInfoF.lowPivots := lowPivots

timeframeInfoF.highPivots := highPivots

timeframeInfoF.lowTimes := lowTimes

timeframeInfoF.highTimes := highTimes

getHigherTFData (timeframeStr) =>

request.security(syminfo.tickerid, getMaxTimeframe(timeframe.period, timeframeStr), [allLowPivots, allHighPivots, allLowTimes, allHighTimes])

pushHighPivots (timeframeInfoF, highPivotF, timeF) =>

if not na(highPivotF)

timeframeInfoF.highPivots.push(highPivotF)

timeframeInfoF.highTimes.push(timeF)

pushLowPivots (timeframeInfoF, lowPivotF, timeF) =>

if not na(lowPivotF)

timeframeInfoF.lowPivots.push(lowPivotF)

timeframeInfoF.lowTimes.push(timeF)

handleTimeframeIfLower (timeframeInfo timeframeInfoF, highs, lows, int[] timesF) =>

if timeframeInfoF.isEnabled and isTimeframeLower(timeframeInfoF.timeframeStr, timeframe.period)

if highs.size() > 0

for i = 0 to highs.size() - 1

timeF = timesF.get(i)

pushHighPivots(timeframeInfoF, highs.get(i), timeF)

if lows.size() > 0

for i = 0 to lows.size() - 1

timeF = timesF.get(i)

pushLowPivots(timeframeInfoF, lows.get(i), timeF)

getLowerTFData (timeframeStr) =>

lowPivots = isTimeframeLower(timeframeStr, timeframe.period) ? request.security_lower_tf(syminfo.tickerid, getMinTimeframe(timeframeStr, timeframe.period), ta.pivotlow(low, pivotRange, pivotRange)) : na

highPivots = isTimeframeLower(timeframeStr, timeframe.period) ? request.security_lower_tf(syminfo.tickerid, getMinTimeframe(timeframeStr, timeframe.period), ta.pivothigh(high, pivotRange, pivotRange)) : na

times = isTimeframeLower(timeframeStr, timeframe.period) ? request.security_lower_tf(syminfo.tickerid, getMinTimeframe(timeframeStr, timeframe.period), time[pivotRange]) : na

[lowPivots,highPivots,times,times]

getTFData (timeframeStr) =>

if isTimeframeLower(timeframeStr, timeframe.period)

getLowerTFData(timeframeStr)

else

getHigherTFData(timeframeStr)

checkIfRSAreSame (RSInfo rsInfo1, RSInfo rsInfo2) =>

if na(rsInfo1) or na(rsInfo2)

false

else if rsInfo1.RSType != rsInfo2.RSType

false

else if rsInfo1.price != rsInfo2.price

false

else

true

checkIfArrHasRS (RSInfo[] arr, RSInfo rsInfoF) =>

if na(arr) or na(rsInfoF)

true

else if arr.size() == 0

false

else

foundRS = false

for i = 0 to arr.size() - 1

arrRS = arr.get(i)

if checkIfRSAreSame(arrRS, rsInfoF)

foundRS := true

break

if foundRS

true

else

false

clearTimeframeRS (timeframeInfoF) =>

oldRetestsCount = 0

oldBreaksCount = 0

if timeframeInfoF.resistances.size() > 0

for j = 0 to timeframeInfoF.resistances.size() - 1

RSInfo RSInfoF = timeframeInfoF.resistances.get(j)

if not na(RSInfoF)

if debug_enabledHistory

if checkIfArrHasRS(oldRSList, RSInfoF) == false

oldRSList.push(RSInfoF)

oldRetestsCount += RSInfoF.retestLabels.size()

oldBreaksCount += RSInfoF.isBroken ? 1 : 0

if timeframeInfoF.supports.size() > 0

for j = 0 to timeframeInfoF.supports.size() - 1

RSInfo RSInfoF = timeframeInfoF.supports.get(j)

if not na(RSInfoF)

if debug_enabledHistory

if checkIfArrHasRS(history, RSInfoF) == false

oldRSList.push(RSInfoF)

oldRetestsCount += RSInfoF.retestLabels.size()

oldBreaksCount += RSInfoF.isBroken ? 1 : 0

timeframeInfoF.resistances.clear()

timeframeInfoF.supports.clear()

[oldRetestsCount, oldBreaksCount]

findTimeframeRS (timeframeInfoF, RSType, arr, count, pivots, times) =>

curRetestsCount = 0

curBreaksCount = 0

if count > 0

for j = 0 to count - 1

foundRS = findLatestNthRS(timeframeInfoF, RSType, pivots, times, j + 1)

if not na(foundRS)

notDuplicate = true

for a = 0 to timeframeInfos.size() - 1

aInfo = timeframeInfos.get(a)

if na(aInfo) or aInfo.isEnabled == false

continue

otherTimeframeArray = (RSType == "Resistance" ? aInfo.resistances : aInfo.supports)

if otherTimeframeArray.size() > 0

for b = 0 to otherTimeframeArray.size() - 1

if checkIfRSAreSame(foundRS, otherTimeframeArray.get(b))

notDuplicate := false

break

if notDuplicate == false

break

if notDuplicate or not debug_removeDuplicateRS

arr.push(foundRS)

if arr.size() > 0

for j = 0 to arr.size() - 1

curRS = arr.get(j)

if not na(curRS)

handleRSInfo(timeframeInfoF, curRS, j, RSType)

curRetestsCount += curRS.retestLabels.size()

curBreaksCount += curRS.isBroken ? 1 : 0

[curRetestsCount, curBreaksCount]

lowPivot = getPivot("low")

highPivot = getPivot("high")

if not na(lowPivot)

allLowPivots.push(lowPivot)

allLowTimes.push(time[pivotRange])

if allLowPivots.size() > maxPivotsAllowed

allLowPivots.remove(0)

allLowTimes.remove(0)

if not na(highPivot)

allHighPivots.push(highPivot)

allHighTimes.push(time[pivotRange])

if allHighPivots.size() > maxPivotsAllowed

allHighPivots.remove(0)

allHighTimes.remove(0)

if calculateTimeSkipMS

if last_bar_index - bar_index < 350 and time - time[1] > timeframe.in_seconds(timeframe.period) * 1000

maxTimeskipMS := math.max(maxTimeskipMS, time - time[1])

[lowPivotsTF1, highPivotsTF1, lowTimesTF1, highTimesTF1] = getTFData(timeframe1)

handleTimeframeIfLower(timeframeInfos.get(0), highPivotsTF1, lowPivotsTF1, highTimesTF1)

[lowPivotsTF2, highPivotsTF2, lowTimesTF2, highTimesTF2] = getTFData(timeframe2)

handleTimeframeIfLower(timeframeInfos.get(1), highPivotsTF2, lowPivotsTF2, highTimesTF2)

[lowPivotsTF3, highPivotsTF3, lowTimesTF3, highTimesTF3] = getTFData(timeframe3)

handleTimeframeIfLower(timeframeInfos.get(2), highPivotsTF3, lowPivotsTF3, highTimesTF3)

//plot(nz(na,timeframeInfos.get(0).highPivots.size() > 0 ? timeframeInfos.get(0).highPivots.get(timeframeInfos.get(0).highPivots.size() - 1) : 0), color = color.blue, title = "High Pivots")

//plot(nz(na,timeframeInfos.get(0).lowPivots.size() > 0 ? timeframeInfos.get(0).lowPivots.get(timeframeInfos.get(0).lowPivots.size() - 1) : 0), color = color.fuchsia, title = "Low Pivots")

if barstate.islast

if timeframe1Enabled and not isTimeframeLower(timeframe1, timeframe.period)

handleTimeframe(1, lowPivotsTF1, highPivotsTF1, lowTimesTF1, highTimesTF1)

if timeframe2Enabled and not isTimeframeLower(timeframe2, timeframe.period)

handleTimeframe(2, lowPivotsTF2, highPivotsTF2, lowTimesTF2, highTimesTF2)

if timeframe3Enabled and not isTimeframeLower(timeframe3, timeframe.period)